ESG Vision

Next Hydrogen believes the significant technological innovations underway to generate, store and use green energy will drive a safer and cleaner future. The Corporation’s mission is to drive a step change reduction in clean hydrogen generation costs from renewable energy sources and enable wide-spread adoption of hydrogen solutions to decarbonize the global economy.

The Corporation also believes that integrating sustainable business practices into their operations and culture is both consistent with their core values and critical to their long-term success.

ESG Project Overview

In support of these beliefs, Next Hydrogen is seeking to embed ESG principles and practices into their organizational structure and operations to:

- support their business objectives

- meet the expectations of stakeholders

- effectively communicate ESG and sustainability performance to investors

- operate in a manner that is consistent with their position as a leader in the transition to a low-carbon economy

In 2021, the Corporation launched an ESG project to help us better understand, prioritize and address their most material industry and company specific ESG risks. Next Hydrogen started by conducting a materiality assessment to identify and prioritize their most material industry and company specific ESG risks. The Corporation started by identifying a set of material ESG topics based on desk analysis of disclosures made by peer companies, ESG rating firms’ assessment frameworks and ESG disclosure standards. This was followed by an internal consultation to ask for feedback on these topics from company executives, board members and key operations personnel.

These project phases are complete, and Next Hydrogen is now designing and implementing their ESG strategy.

ESG Initiatives and Commitments

Sustainable Products

Hydrogen production from green energy can dramatically reduce carbon footprints while enhancing reliability of supply. Water electrolysis is the only means to produce green hydrogen, and Next Hydrogen’s electrolysers were created to capture the entire output range of intermittent or fluctuating sources of electrical power, allowing for integration with renewable power generation.

Renewable Energy and Carbon Offsets

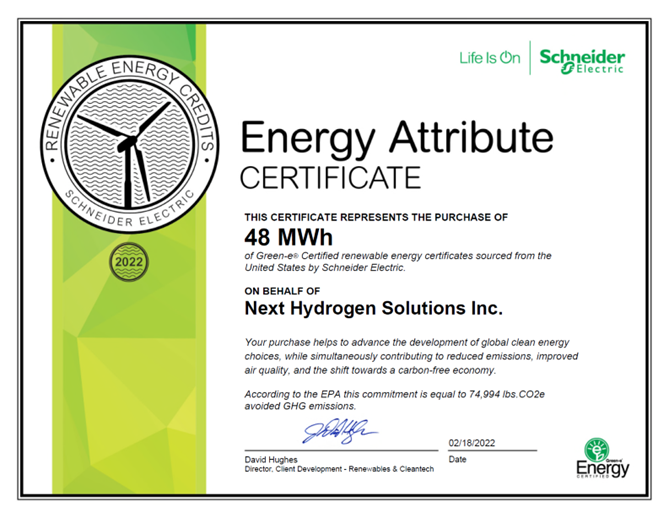

Next Hydrogen recently signed an agreement for the purchase of Green-e® certified renewable energy certificates (RECs) to cover 100% of 2021 electricity used in their offices and manufacturing facilities.

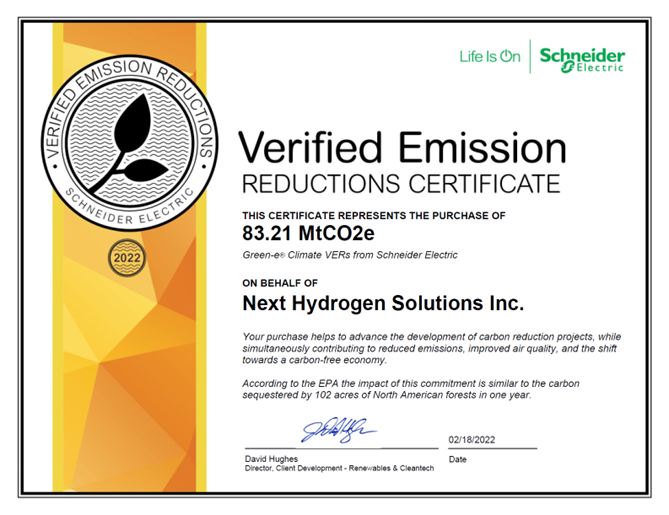

The Corporation also signed an agreement to offset 2021 CO2e emissions from their natural gas use and employee travel. The offsets, which are certified by Green-e® Climate, meet the standards of the American Carbon Registry, the Climate Action Reserve, the Gold Standard or the Verified Carbon Standard.

ESG Policies

During 2021, Next Hydrogen developed policies to strengthen their ability to manage their most material ESG risks. These include:

- Code of Business Conduct and Ethics

- Diversity Equity Inclusion and Belonging Policy

- Health Safety and Environment Policy

Executive and Board Diversity

Next Hydrogen’s commitment to building and fostering a fair and inclusive workplace is reflected in the composition of their Board of Directors and executive team. Their eight-person Board includes one woman (12.5%) and two racialized people (25%). One of their senior executives is a woman (25%) and two are racialized (50%).

Suppliers

Next Hydrogen seeks out vendors that offer products with a focus on sustainability. For example, the Corporation utilizes a system that allows us to minimize the environmental impacts of their office supply purchases, and their cash balances are held in a “green” deposit account that funds loans for environmentally focused projects.

ESG Governance

Next Hydrogen has enhanced their oversight of ESG issues over the past year:

- The Board of Directors has formal responsibility for oversight of ESG matters

- The Board receives quarterly reports on ESG matters

- Operational responsibility for ESG issues has been assigned to a senior member of the executive team and the Corporation has engaged an ESG advisory firm to assist in the development and execution of their ESG strategy.

The executive team and Board are exceptionally qualified to deliver on the company’s business and ESG objectives. They bring significant business and operational expertise in, among other areas, strategy, business development, project finance, capital markets, hydrogen technology development, R&D, engineering, operations and manufacturing.

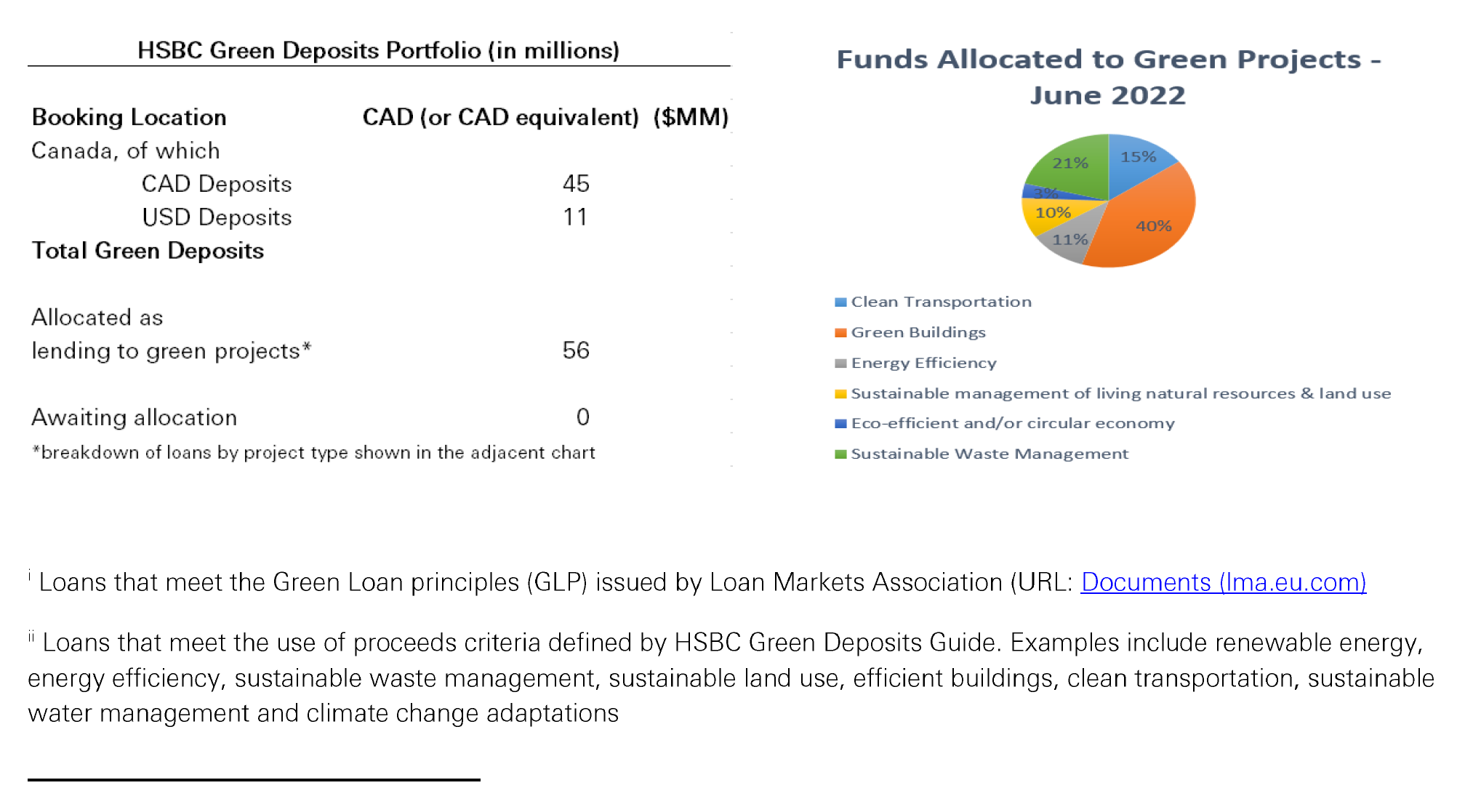

HSBC Green Deposits Report

March 31, 2022

HSBC Green Deposits aim to support your environmental goals by allocating funds raised from these deposits to finance eligible businesses and projects that provide clear environmental sustainability benefits while mitigating environmental and/or social risk. The qualifying criteria for such businesses and projects are set out in the HSBC Green Deposits Factsheet. Please contact your usual HSBC representative or HSBC’s Sustainability policy for more information on our ESG initiatives.

The report provides information on the allocation of funds raised via the HSBC Green Deposits program. The amounts provided below are aggregated values of deposits raised from all depositors including yourself. The assets’ amounts are also aggregated values of loans and financing made to multiple HSBC customers.

For actual balances in your Green Deposit amount, please refer to your bank statement or log-in to HSBCnet Account Information.